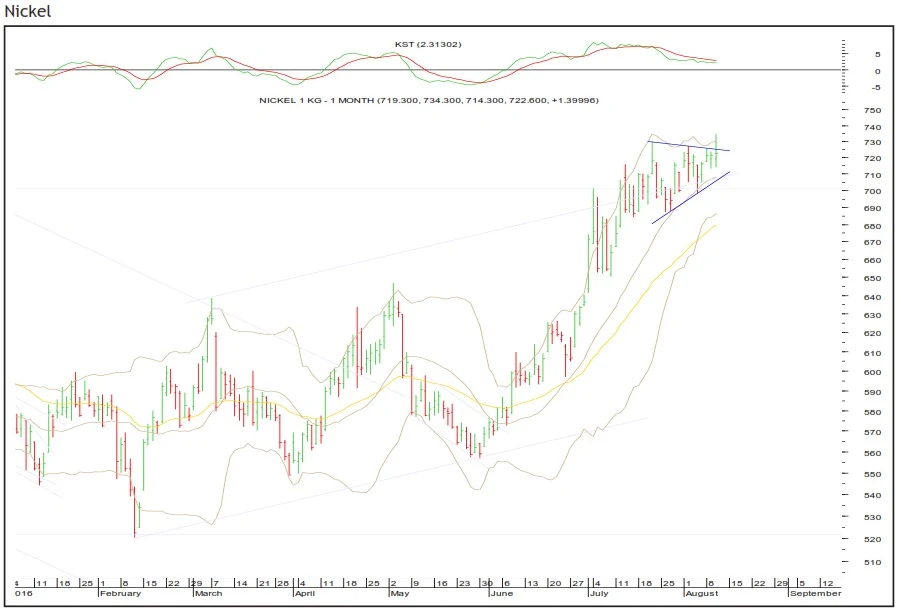

The adjacent chart shows price movement of MCX nickel continuous contract. It has rallied significantly in the last few weeks, but in the last few sessions it is trading sideways. It seems to have formed a triangular pattern, which looks like a distribution structure. The short-term momentum indicator is showing a negative divergence, which is a bearish sign. In the last session, the base metal made an attempt to surpass the upper end of the trading range, but tumbled back into the range on a closing basis. Rs.730-735 is a key resistance zone, unless this is crossed on a closing basis, nickel can start the next leg down. Rs.686-680 will be the target area from a short term perspective. Rs.710-708 will act as an intermediate support zone.